Business History, Collectibles and Investments, Pop Culture

The Beanie Baby Stock Market Crash: How Stuffed Toys Cost People Thousands in 2000

The Rise of Beanie Babies: A Collectible Phenomenon

In the early 1990s, Beanie Babies emerged from Ty Inc., a company founded by Ty Warner, as a unique line of stuffed toys filled with plastic pellets, giving them a distinctive feel and appearance. Initially introduced in 1993, these plush toys quickly captured the hearts of children and adults alike. The combination of adorable designs and an intriguing marketing approach led to an unprecedented rise in popularity, transforming Beanie Babies into cultural icons and highly sought-after collectibles.

One of the pivotal strategies employed by Ty Inc. was the creation of limited editions and exclusive releases, which sparked an intense collector frenzy. The company often retired certain Beanie Babies after short production runs, fostering a sense of urgency among consumers. This marketing move played a crucial role in driving demand and enabling collectors to perceive their purchases as investments. Consequently, many fans raced to acquire these plush toys, believing they would appreciate significantly in value over time. The allure of owning a rare Beanie Baby often overshadowed the simplicity of the toys themselves, as they became symbols of status and savvy investing.

Personal anecdotes from collectors illustrate the obsession surrounding Beanie Babies during their peak. One avid collector recalled spending weekends visiting local shops, hunting for the elusive “Princess” bear or the special edition holiday releases. Another enthusiast described the thrill of attending trade shows, where passionate individuals exchanged stories, and rare finds ignited excitement. These personal stories reflect the deep emotional connection many collectors formed with their Beanie Babies, treating them not merely as toys but as cherished possessions that reflected their identity and aspirations.

Thus, the Beanie Baby phenomenon was more than just a fleeting trend; it marked the intersection of consumer culture, nostalgia, and investment psychology. The early years of this stuffed toy empire established the foundation for a booming secondary market, setting the stage for the eventual economic consequences that would follow in the early 2000s.

The Hype: How Beanie Babies Became a Financial Investment

The story of Beanie Babies transcends their status as mere stuffed toys; they evolved into a cultural phenomenon and a potential financial investment during the late 1990s. The marketing strategy employed by Ty Inc. positioned these plush creations not only as delightful companions for children but also as collectibles that could secure financial futures for their owners. The psychological allure of owning something rare and unique spurred a new mentality among collectors, who began to perceive Beanie Babies as viable assets akin to stocks or precious metals.

Online marketplaces and forums played a pivotal role in elevating the perceived value of Beanie Babies. E-commerce platforms such as eBay emerged as a digital trading floor where enthusiasts could buy, sell, and auction these cherished items, often at inflated prices. The accessibility of these platforms allowed collectors to showcase their collections and engage with others, leading to a shared narrative that fueled demand. As prices skyrocketed, the frenzy surrounding Beanie Babies commanded headlines in mainstream media, which further amplified their desirability. Articles lauding these toys as “the next big investment” helped to cement their status as must-have collectibles, drawing in not only children but also adults seeking financial security.

Many consumers shared compelling stories of their investment strategies, showcasing how they sought to identify rare and limited-edition Beanie Babies. This sense of community fostered a unique collector culture where individuals advised one another on market trends, creating a sense of urgency to acquire these toys before prices escalated even further. The combination of emotional attachment to the toys and the financial ambitions of collectors culminated in a perfect storm of enthusiasm, ultimately leading many to invest thousands of dollars with the hope that their beloved plush toys would yield significant returns. This confluence of psychological factors and market dynamics marked the transformation of Beanie Babies from simple playthings to objects of investment, setting the stage for the ensuing crash that would fundamentally alter collectors’ perceptions of their value.

The Crash: Factors Leading to the Decline of Beanie Baby Value

The Beanie Baby phenomenon, which captured the hearts of collectors throughout the 1990s, witnessed a dramatic decline starting in the late 1990s, peaking catastrophically in 2000. Several interrelated factors contributed to this rapid collapse in value, echoing the characteristics of a financial bubble. One primary reason was the overproduction of these plush toys. Initially marketed as rare collectibles, Beanie Babies began flooding the market as Ty, Inc., the producer, ramped up its production to meet escalating demand. This saturation diminished the perceived rarity that many collectors valued so highly, leading to a drop in prices.

Alongside overproduction, the loss of exclusivity played a significant role in the decline. As new models continued to be released, collectors who once had an exquisite collection soon found themselves with items that were no longer regarded as exclusive or valuable. The perception shifted rapidly; collectors now viewed the once sought-after Beanie Babies as ubiquitous, resulting in decreased market sentiment.

Changing consumer interests also contributed to the downward trajectory of Beanie Baby values. As the new millennium approached, the allure of other collectibles emerged, diverting attention and funds away from Beanie Babies. Collectors began turning to different interests, such as electronic devices, which became more appealing and representative of the digital age. This shift left the Beanie Baby market struggling to adapt to the evolving preferences of consumers.

Anecdotal accounts from former collectors illustrate the emotional turmoil that accompanied this decline. Many individuals who had invested substantial money and time into their collections faced not only financial loss but also a sense of disillusionment. Families who once found joy in buying and trading Beanie Babies were left reflecting on their market decisions with regret. Ultimately, the convergence of overproduction, loss of exclusivity, changing consumer interests, and the rise of competing collectibles served to undermine the Beanie Baby market, leading to its catastrophic crash in value. This period remains a cautionary tale about the volatility of collectible markets.

Lessons Learned from the Beanie Baby Saga

The Beanie Baby phenomenon of the 1990s serves as a compelling case study for investors and collectors alike. The initial excitement surrounding these stuffed toys led to astronomical price points driven by consumer hype rather than intrinsic value. This phenomenon underscores the significance of conducting thorough market research before making investment decisions. Investors should not be merely swayed by trends or fads; understanding the real value of collectibles is essential in establishing sound investment strategies.

One of the key takeaways from the Beanie Baby saga is the distinction between perceived value and true value. At the height of their popularity, many collectors often construed the prices of Beanie Babies as indicators of their worth, creating a dangerous misconception. When the fad subsided, the market was saturated with unpurchased toys, leading to significant financial losses for those who had wrongly assumed that prices would continue to rise indefinitely. This lesson can be applied to current collectible markets, where similar patterns can also be observed. For example, contemporary assets such as Funko Pop figures or Pokémon cards have seen price spikes during their respective surges yet are now subject to volatility.

Furthermore, the Beanie Baby crash illustrates the risks associated with fad collectibles. Investors should be wary of markets driven by fleeting interests, as these can lead to inflated pricing followed by drastic declines. To mitigate risk, newcomers should prioritize educating themselves about the items they collect, analyzing market trends, and diversifying their collections instead of focusing solely on high-demand fads.

Ultimately, the Beanie Baby saga serves as a cautionary tale for all collectors and investors. By applying these lessons, individuals can foster a more prudent approach to their collecting and investing endeavours, ensuring they navigate the complexities of the market with greater confidence and awareness.

Business and Finance

Business and Finance

Business and Finance

🏢 Vandelay Industries Unisex Sweatshirt – Importing. Exporting. Comfort.

Business and Finance

Business and Finance

Business and Finance

🏢 Vandelay Industries Unisex T-Shirt – Importing. Exporting. Legendary.

Business and Finance

“Business Goose” Unisex T-Shirt – Professional Chaos in Style

Business and Finance

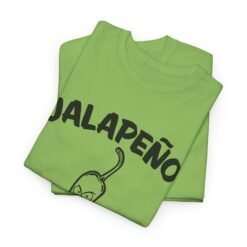

🌶😠 Jalapeño Business Unisex T-Shirt – Spicy Attitude, Extra Sass