Business History, Weird History

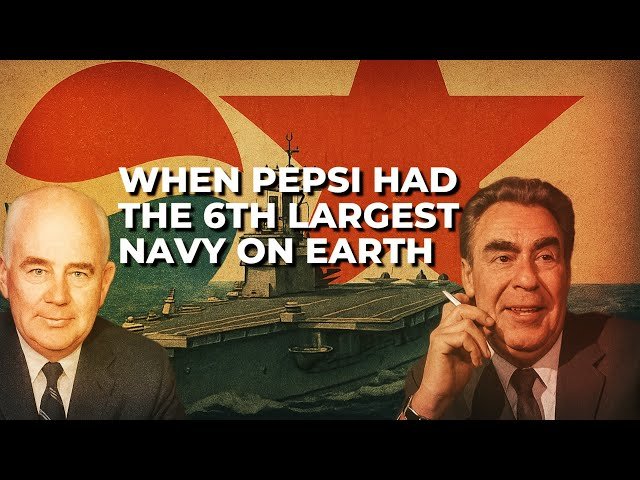

When Pepsi Became a Naval Power: The Story of the Soviet Fleet Acquisition

The Origins of Pepsi’s Unconventional Navy

The late 1980s marked a significant period of transition for the global political landscape, particularly in the context of the Soviet Union. It was during this era of change, amidst growing economic challenges and political reform under Mikhail Gorbachev’s leadership, that innovative strategies emerged in the corporate sector, particularly from multinational companies seeking entry into new markets. PepsiCo, a leading American beverage corporation, found itself in a unique position to capitalize on these circumstances.

The dissolution of the Soviet Union in 1991 created an environment rife with uncertainty and a need for more robust economic models. The transition from a centrally planned economy to a market-oriented one left many Soviet enterprises stranded, searching for viable alternatives for trade. PepsiCo recognized this gap and saw an opportunity that went beyond the standard distribution of soft drinks. The company’s management employed an unconventional approach that would turn a beverage company into a naval power—quite literally.

By leveraging its established beverage distribution network, PepsiCo crafted a deal that not only introduced its sugary drinks to the Soviet market but also facilitated the acquisition of surplus naval vessels. This strategic maneuver was predicated on the belief that the Soviet Union, in need of alternative means to facilitate transactions, could exchange valuable naval assets for consumer goods. The resulting agreement allowed Pepsi to gain ownership of a fleet of naval ships, effectively positioning the company as an unlikely player in maritime affairs. The implications of this acquisition were profound, illustrating the convergence of business and geopolitical change and marking a pivotal moment in the history of global commerce.

The Acquisition of the Soviet Fleet

The acquisition of the Soviet fleet by Pepsi in the early 1990s is a fascinating chapter in both corporate history and international relations. At a time when the Soviet Union was on the brink of collapse, Pepsi found a unique opportunity to leverage its syrupy presence in the local market. In a bold and unusual move, the company negotiated a deal that granted them ownership of over 17 naval vessels, including formidable submarines and destroyers. This remarkable transaction was not merely a commercial strategy but also a pivotal moment in the interplay between U.S. corporate entities and the waning power of the Soviet military.

Behind this strategic acquisition were key figures from both sides. On Pepsi’s end, the leadership, including then-CEO Donald Kendall, saw the potential for a not only audacious promotional campaign but also a means to showcase the company’s resourcefulness in acquiring valuable assets. The negotiations were complex, involving multiple stakeholders, including Soviet authorities who were eager to embrace foreign investment to revive their faltering economy. In return for the fleet, Pepsi gained the right to operate a lucrative soft drink business in the Soviet market, illustrating the pragmatic approach of establishing ties with a country in economic turmoil.

The value ascribed to the ships was considerable, given their military capabilities, although the operational status of these vessels raised questions. Many had fallen into disrepair due to years of neglect, which meant that their immediate utility was somewhat limited. Nevertheless, Pepsi’s acquisition represented a significant legal maneuver and highlighted the blurred lines between military assets and commercial opportunities. Ultimately, this unprecedented deal exemplified how U.S.-Soviet relations facilitated unconventional business strategies during a pivotal moment in history.

Pepsi’s Naval Strategy and its Implications

Pepsi’s innovative strategy surrounding the acquisition of a naval fleet represented a unique intersection of business and international diplomacy. Recognizing the fierce competition within the soft drink industry, Pepsi sought to distinguish itself by embracing an unconventional approach. The fleet’s primary function was not solely military; rather, its role was envisioned as a symbol of economic prowess and competitive edge, which would resonate with consumers and business partners alike. By integrating a naval fleet into its operations, Pepsi intended to solidify its presence in international markets, particularly in regions where perceptions of American products were mixed.

The symbolic nature of this acquisition cannot be understated. Aligning itself with a robust naval power not only showcased Pepsi’s financial stability but also positioned the company as a significant player on the global stage. Potential operations foreshadowed opportunities for logistical support in distributing products to new markets. Furthermore, the underlying message reiterated Pepsi’s commitment to establishing a lasting brand presence in the USSR, thus enhancing its image as a forward-thinking corporation willing to engage in international affairs.

Additionally, Pepsi’s ascension as a naval power bore important geopolitical implications. This strategic move altered relationships not only with competitors like Coca-Cola but also within the broader context of U.S.-Soviet relations during the Cold War. The acquisition fostered an environment where commercial interests mixed with political ambitions, a dynamic previously unseen in the beverage industry. The perception of Pepsi as a major economic influencer reshaped consumer expectations, engendering a sense of pride and nostalgia among Soviet citizens eager for Western goods.

In summary, Pepsi’s naval strategy was more than a mere business strategy; it was a bold experiment in branding and international engagement, intricately linking commerce with geopolitics in profound ways.

The Fallout: From Navy to Focus on Drinks

The story of Pepsi’s naval acquisition took a dramatic turn with the dissolution of the Soviet Union in 1991. Initially, acquiring a fleet of naval ships was a bold move that showcased Pepsi’s ambitious corporate strategy to expand its market influence. However, the geopolitical landscape shifted rapidly, leading to significant changes in the operational capabilities of the Soviet Navy. The once formidable fleet, which Pepsi had envisioned as a means to solidify its international standing, became increasingly obsolete. With the collapse of the Soviet Union, the strategic direction of these acquisitions came into question.

The fate of the ships was closely tied to the instability of the region following the dissolution. Many of the vessels were left decommissioned and neglected, losing their operational purpose. As the focus of policy shifted towards rebuilding and restructuring the Russian economy, the military assets, including those acquired by Pepsi, were no longer viable investments. Consequently, Pepsi had to navigate this unexpected fallout, which involved divesting from its naval ambitions.

The remarkable chapter of Pepsi’s foray into naval power serves as a quirky yet instructive instance in marketing and business history. It exemplifies how bold strategic decisions may be affected by larger forces beyond a corporation’s control, emphasizing the importance of aligning business practices with the prevailing global climate.

Business and Finance

“Buy Local Coffee, Or Don’t, Whatever” Unisex T-Shirt – Caffeinated Sass

Business and Finance

“Business Goose” Unisex T-Shirt – Professional Chaos in Style

Business and Finance

“Biff Tanner’s Pleasure Paradise – Hill Valley, CA” Unisex T-Shirt – Retro 80s Throwback

Business and Finance

Business and Finance

🦷 Dr. King Schultz Surgeon Dentist Unisex T-Shirt – Old-Fashioned Charm Meets Tarantino Style

Business and Finance

Business and Finance

🌶😠 Jalapeño Business Unisex T-Shirt – Spicy Attitude, Extra Sass

Business and Finance

☕🛡️🚀 Bounty Hunting Black Mug – Complicated Coffee for a Complicated Profession